Demystifying CryptoCurrency : Exploring the Advantages, Disadvantages, and Impact on the Economy

Cryptocurrency, also known as digital or virtual currency, has been a buzzword for the past few years. It refers to a form of decentralized digital currency that uses encryption techniques to regulate the generation of units of currency and verify the transfer of funds. The most popular cryptocurrency is Bitcoin, which was launched in 2009, but since then, many other cryptocurrencies have emerged. In this blog post, we will explore the world of cryptocurrency and its impact on the economy.

History of Cryptocurrency

The history of cryptocurrency can be traced back to 2008 when a person or group using the pseudonym Satoshi Nakamoto created the first cryptocurrency, Bitcoin. The main aim of Bitcoin was to create a decentralized currency that was not controlled by any government or financial institution. Since then, many other cryptocurrencies, such as Ethereum, Litecoin, and Ripple, have emerged.

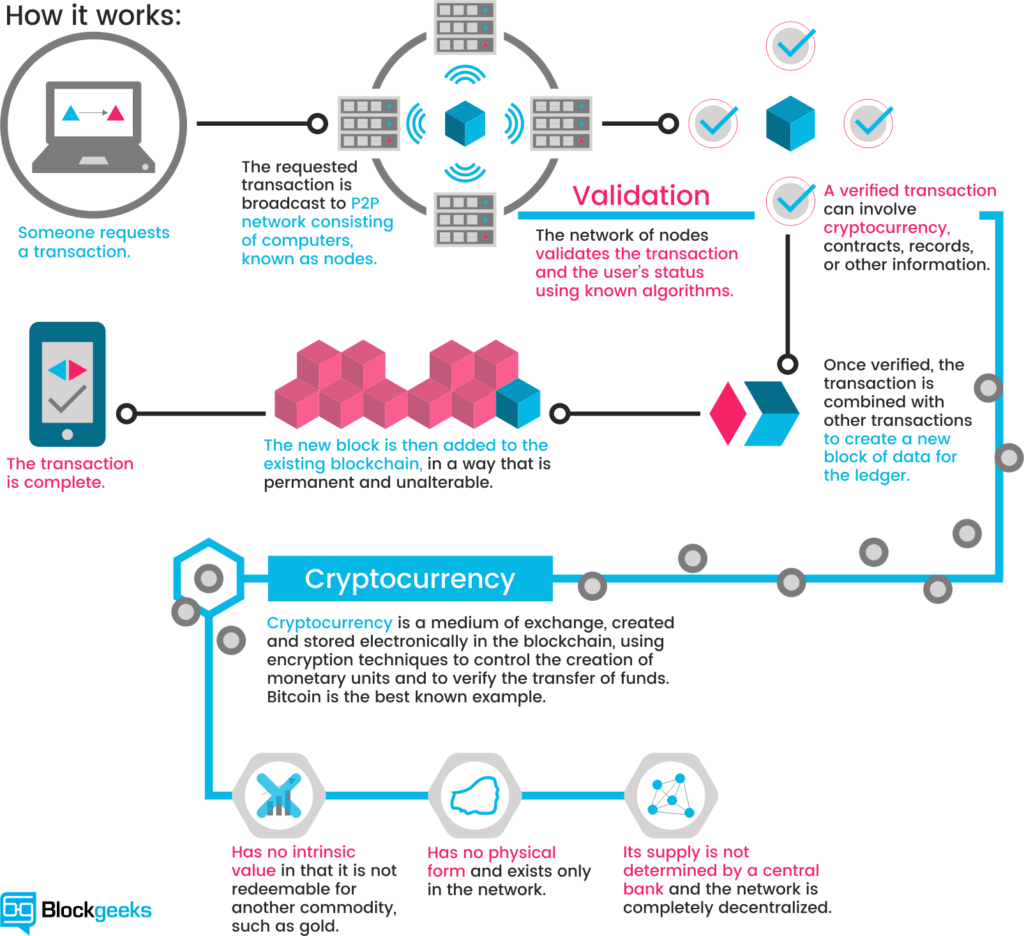

How Does Cryptocurrency Work?

Cryptocurrencies operate on a decentralized system, which means they are not controlled by a central authority or institution. Instead, they use blockchain technology, which is a decentralized ledger that records every transaction made using the currency. Each block in the chain contains a cryptographic hash of the previous block, creating a secure and tamper-proof ledger.

Cryptocurrencies are generated through a process called mining, which involves solving complex mathematical equations to validate transactions and add new blocks to the blockchain. Miners are rewarded with newly generated coins for their efforts, which incentivizes them to keep the blockchain secure and up to date.

Advantages of Cryptocurrency

One of the main advantages of cryptocurrency is its decentralized nature, which means it is not controlled by any central authority or government. This makes it more resistant to fraud and manipulation than traditional currencies. Additionally, cryptocurrency transactions are generally faster and cheaper than traditional bank transfers, and they can be made anonymously.

Another advantage of cryptocurrency is its potential to provide financial access to people who are unbanked or underbanked. Since cryptocurrencies are not tied to traditional banking systems, they can be used by anyone with an internet connection, regardless of their location or financial status.

Another advantage of cryptocurrency is its potential to provide financial privacy and security. Traditional banking systems are vulnerable to hacking and data breaches, which can put people's financial information at risk. Cryptocurrency transactions, on the other hand, are encrypted and secure, making them less susceptible to fraud and theft.

Disadvantages of Cryptocurrency

Despite its many advantages, cryptocurrency also has some disadvantages. One of the main concerns is its association with criminal activity, such as money laundering and illegal transactions. This is due to the anonymity provided by cryptocurrency transactions, which makes it difficult for law enforcement agencies to track down criminals.

Another disadvantage of cryptocurrency is its high volatility. Cryptocurrencies are known for their wild price swings, which can make them a risky investment. Additionally, since cryptocurrencies are not regulated by any central authority, there is no guarantee that they will retain their value in the long term.

However, the potential benefits of cryptocurrency come with significant risks and challenges. One of the most significant risks is its association with illegal activities, such as money laundering and drug trafficking. Cryptocurrency transactions can be difficult to trace, making them attractive to criminals who want to launder money or engage in other illicit activities.

Another challenge is the high volatility of cryptocurrency prices. Cryptocurrencies are known for their wild price swings, which can make them a risky investment. In 2017, for example, the price of Bitcoin skyrocketed from around $1,000 to nearly $20,000, before crashing back down to around $3,000 the following year.

Impact of Cryptocurrency on the Economy

The impact of cryptocurrency on the economy has been a topic of debate among economists and financial experts. Some see it as a disruptive force that could replace traditional banking systems and provide financial access to the unbanked. Others see it as a speculative bubble that could burst at any moment.

One potential impact of cryptocurrency on the economy is its ability to facilitate cross-border transactions. Since cryptocurrencies are not tied to traditional banking systems, they can be used to transfer money across borders quickly and cheaply, without the need for intermediaries.

Another potential impact of cryptocurrency on the economy is its potential to disrupt traditional banking systems. Since cryptocurrencies are decentralized, they could provide an alternative to traditional banking systems, which are often slow, expensive, and inaccessible to many people.

Despite these risks, the potential benefits of cryptocurrency have caught the attention of investors and entrepreneurs around the world. Many companies are exploring ways to use blockchain technology to streamline their operations and provide better services to their customers. Cryptocurrency has also given rise to a new form of fundraising called Initial Coin Offerings (ICOs), which allow startups to raise money by issuing digital tokens.

Conclusion

Cryptocurrency is a complex and rapidly evolving field that has the potential to revolutionize the way we think about money and finance. While there are many potential benefits to using cryptocurrency, there are also significant risks and challenges. As we move forward, it will be important to continue exploring the potential impact of cryptocurrency on the economy and society, and to develop strategies for managing its risks and maximizing its potential benefits. The future of cryptocurrency is uncertain, but it is clear that it will continue to be a topic of interest and discussion in the years to come.

As cryptocurrency continues to gain popularity, more and more businesses are beginning to accept it as a form of payment. This has the potential to significantly increase the adoption and mainstream acceptance of cryptocurrency, which could lead to even greater innovation and growth in the field.

It is also worth noting that some governments and financial institutions are beginning to take a more active role in regulating the cryptocurrency market. This could help to address some of the concerns around criminal activity and volatility, while also providing more stability and security for investors.

Overall, the world of cryptocurrency is complex and rapidly evolving, but it is clear that it has the potential to significantly impact the economy and society as a whole. Whether you are an investor, a business owner, or simply a curious observer, it is important to stay informed about the latest developments and trends in this exciting field. As we continue to explore the potential of cryptocurrency, we will undoubtedly discover new and innovative ways to use it to transform the world of finance and beyond.

Comments

Post a Comment